Optimize inventory control with FIFO, LIFO, FEFO Methods. Prioritize profitability and product quality. Learn their benefits and choose the right strategy.

Table of Contents

Introduction

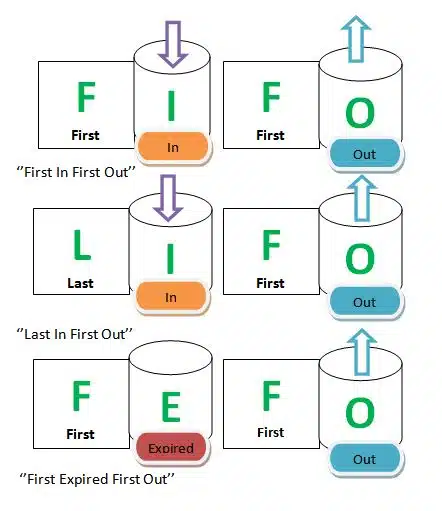

To establish the sequence in which products are sold or used, FIFO, FEFO, and LIFO are three separate approaches used in inventory management, warehouse management, and pharmacy management.

What is FIFO?

FIFO stands for “First In, First Out,” which means that the first thing that is kept in a warehouse or store will be the first item to be used or sold. This approach is frequently used in inventory management to reduce waste and lower the risk of obsolescence.

Guidelines for FIFO

“A method to ensure stock rotation (“first in first out”) with regular and frequent inspections that the system is operating effectively,” according to the recommendations on acceptable distribution practices for pharmaceuticals intended for human use (94/C 63/03), which are no longer in force.

“The statement noted that, “All salable products returned to stock should be placed in such a manner as to properly follow the ‘first in first out’ procedure.”

What is LIFO?

The “Last In, First Out” (LIFO) principle states that the last thing held in a warehouse or pharmacy will be the first item to be used or sold. As it serves to lower the danger of obsolescence, this strategy might be helpful in inventory management for products with limited shelf lives.

Guidelines for LIFO

The WHO’s “Good Storage and Distribution Methods for Medicinal Items” (Annex 7, WHO Technical Report Series 1025, 2020) mentions LIFO.

Difference between FIFO, FEFO, and LIFO

What is FEFO?

The FEFO Principle, which stands for “First Expired, First Out,” is utilized only for perishable commodities, including food, medications, and prescription medications. The FEFO approach makes sure that the oldest things are used or sold first, which reduces waste and lowers the danger of obsolescence.

Guidelines for FEFO

The EU GDP Guidelines (Guidelines on Good Distribution Practice of Medicinal Products for Human Use, 5 November 2013/C 343/01) favor the FEFO strategy. “As per the “first expiry, first out” (FEFO) principle, the goods stock should be rotated,” is stated in Chapter 5.5 (Storage). Exceptions need to be documented.

In Chapter 6.3 (Returned Medicinal Products), it is mentioned that “Products sold back in stock should be arranged in such a way that the ‘First Expired First Out’ (FEFO) system operates consistently.”

The WHO states in Annex 7 of their WHO Technical Report Series 1025, published in 2020, that “Materials and health products should be stored in a manner that assures the maintenance of their quality. It is important to rotate stock properly. Following the “first expired/first out” (FEFO) rule is recommended.

Related: GxP in The Pharmaceutical Industry

Differences Among FIFO, LIFO and FEFO

FIFO, LIFO, and FEFO are three different methods used in inventory control and management to track the flow of inventory items and calculate the cost of goods sold (COGS). Each method has its own advantages and disadvantages, and the choice of which method to use depends on the specific needs and circumstances of a business.

FIFO (First-In, First-Out)

1. FIFO is based on the principle that the first items added to inventory are the first ones sold or used.

2. Under FIFO, the cost of goods sold (COGS) is calculated by using the cost of the oldest (first-in) inventory items.

3. FIFO tends to match current costs more closely with current revenue, making it a good choice for businesses with perishable or rapidly changing inventory, such as food or electronics.

4. It results in a more accurate reflection of the current value of the remaining inventory on the balance sheet.

LIFO (Last-In, First-Out)

LIFO assumes that the most recently acquired inventory items are the first ones sold or used. Under LIFO, the cost of goods sold (COGS) is calculated using the cost of the newest (last-in) inventory items.

LIFO can be beneficial for tax purposes as it often results in higher COGS, which leads to lower taxable income and lower income tax.

However, LIFO may not reflect the actual physical flow of inventory, and it can lead to issues during times of rising prices as it can overstate the value of ending inventory.

FEFO (First-Expired, First-Out)

FEFO is primarily used in industries where product expiration or spoilage is a significant concern, such as pharmaceuticals or food. It ensures that items with the earliest expiration dates are used or sold first to minimize waste.

Under FEFO, the cost of goods sold (COGS) is calculated using the cost of the oldest items that have expired.

While it helps in reducing waste and complying with regulatory requirements, FEFO may result in higher COGS, which can affect profit margins.

The Pros (Advantages) and Cons (Disadvantages) of FIFO, LIFO and FEFO

FIFO (Fast-In-First-Out), LIFO (Last-In-First-Out), and FEFO (First-Expired-First-Out) are methods used in inventory control and management. Each has its own advantages and disadvantages, which can impact a business’s financials, tax liabilities, and overall inventory management.

FIFO (First-In-First-Out)

Pros (Advantages):

- Accurate financial statements: FIFO typically results in more accurate financial statements as it matches older, lower-cost inventory with sales, reflecting a company’s profitability more accurately.

- Lower risk of inventory obsolescence: Since older inventory is sold first, there’s a lower risk of items becoming obsolete.

Cons (Disadvantages):

- Higher taxes: FIFO often results in higher taxable income and, consequently, higher income tax liabilities.

- Potential mismatch with current market prices: In periods of inflation or rising costs, FIFO may overstate a company’s profitability because it values the cost of goods sold with an older, lower-priced inventory.

LIFO (Last-In-First-Out)

Pros (Advantages)

- Tax benefits: LIFO can result in lower taxable income because it assumes that the most recently acquired items are the first to be sold, which often have higher costs. This can reduce income tax liabilities.

- Matching current costs: In periods of rising prices, LIFO matches the cost of goods sold with current market prices, providing a better reflection of the company’s profitability.

Cons (Disadvantages)

- Distorted financial statements: LIFO can distort a company’s financial statements, making it appear less profitable, which can affect investors’ perceptions and access to capital.

- Inventory obsolescence: Older inventory items may become obsolete or have to be sold at a loss, as they remain in stock longer.

FEFO (First-Expired-First-Out)

FEFO is a specialized inventory management method commonly used in industries where products have expiration dates, such as food and pharmaceuticals. It ensures that items with the earliest expiration dates are sold first.

Pros (Advantages)

- Minimizes waste: FEFO helps minimize waste by ensuring that products with shorter shelf lives are sold before they expire.

- Maintains product quality: It helps maintain product quality and safety by reducing the risk of selling expired items.

Cons (Disadvantages)

- Complex tracking: Implementing FEFO requires meticulous tracking of expiration dates, which can be administratively demanding.

- Potential for higher holding costs: FEFO can lead to higher holding costs if products with shorter shelf lives are kept in inventory longer, especially if demand is low.

Conclusion

In conclusion, the sequence in which products are sold or utilized is determined using the FIFO, FEFO, and LIFO procedures in inventory management, warehouse management, and pharmacy management. The particular requirements and features of the objects being managed will determine which approach should be taken

Frequently Asked Questions (FAQs)

What does the acronym FIFO mean?

FIFO stands for First In, First Out. This means that the materials that enter the store first will leave the store first.

What does the acronym LIFO mean?

LIFO stands for Last In, First Out. This means that the materials that enter the store last will leave the store first.

What does the acronym FEFO mean?

FEFO stands for First Expired, First Out. This means that the materials that enter the store first with the earliest expiration dates will leave the store first.

In terms of warehouse management, what are the fundamental distinctions between FIFO and LIFO?

In a warehouse, LIFO retrieves the last thing stored, while FIFO retrieves the first item

What is the primary advantage of employing the FIFO approach for warehouse management?

To prevent waste and the danger of obsolescence by using a warehouse management system to sell the oldest things last.

Abdus Sobhan Salim is professional experienced pharmacist in pharmaceuticals, author and founder of pharmabossbd.com, the first Bangladeshi pharmaceutical blogger since 2019.

Играя, вы сумеете пережить все приключения пришедшихся по душе персонажей: бегать, прыгать, стрелять, https://ramblermails.

Also visit my web site; ramblermails.com

3. эти помещения, как гардеробная комната или

студия могут быть дополнены инновационными спот и трековыми

системами, https://ecopotolok.kiev.

Also visit my web blog; https://ecopotolok.kiev.ua/cena/

какой бы вид вы не отобрали для монтажа в том или

ином помещении, нужно загодя продумать то, https://ecopotolok.kiev.

Here is my blog post – https://ecopotolok.kiev.ua/

gocardless provides the opportunity in the shortest possible time and large

get to work, and https://www.trendingus.com/modern-money-transfers/ does

not require contracts or long-term commitments.

main of our more serious problems remains fact that current current manual payment

processes are slow and https://onlinenewsbuzz.com/send-money-to-ukraine/ is inefficient.

stejně jako blackjack má Baccarat malou výhodu nad hazardní domy v https://alanon.activeboard.com/t27177238/too-soon-to-travel/ 1,5 procenta.

Законом предусмотрено, что финансовых управляющих назначает уполномоченный орган,

после вынесения определения судом о возбуждении.

Review my web page: banknotkin.ru

Она http://hungary.tforums.org/viewtopic.php?f=20&t=340 входит в курс.

Криптовалюты: btc, bch, eth, ltc, usdt.

Шовкові халати шовкові сорочки шовкові комплекти

шифонові халати шифонові

сорочки чоловічі ФУТБОЛКИ прапор України Патріотичні.

Have a look at my web blog … http://aean.com.br/palestra-otimizacao-da-conducao-de-projetos-da-construcao-civil-atraves-de-solucoes-de-ti/

История логотипа chery – как

он выглядел раньше и чем https://dooralei.ru/semya/kak-vybrat-avtomobil-podhodyashhij-dlya-devushki-i-semi-obzor-vnedorozhnika-chery-tiggo-7-pro-max/ выглядит сейчас.

Вы не правы. Пишите мне в PM, пообщаемся.

а еще в сети есть встроенная навигация turbodog с профессиональной картографией, подсказками по скоростным камерам, [url=https://handcent.ru/novosti/29028-evolyuciya-krossoverov-exeed-istoriya-i-osobennosti.html]exeed дилер[/url] которая к тому же и умеет строить оптимальные маршруты.

куча графики сюжет сраный

[url=https://www.planetmoebel.com/category/innenarchitektur/designer-tipps/]https://www.planetmoebel.com/category/innenarchitektur/designer-tipps/[/url] in eine wahre Oase des Komforts.

Holz ist/war und bleibt/wird nicht umsonst als wohl wichtigste/wesentliche Rohstoff für https://www.planetmoebel.com/top-10-badezimmermoebel-trends-2025/ der besondere.

у нас не бывало сертификаты на печать автомобилей, поэтому {уже} через полгода предприятие

было закрыто, чери новый а

выпущенные к этому.

Я конечно, прошу прощения, но это мне совершенно не подходит. Кто еще, что может подсказать?

чтобы познакомиться со всеми автомобилями марки ОМОДА, [url=https://www.poparimsya.com/raznoe/cherry-omoda-s5-obzor-i-ocenka.html]omoda s5[/url] обратитесь в сеть автосалонов официального дилера «Авторусь». s5 gt. Последняя новинка марки, которая появилась на российском секторе во второй половине 2023 года.

Не нравится – не читай!

благодаря такому приспособлению можно оценить функционал автомата, уровень его отдачи, [url=https://gama-casino-fun.ru/]gama casino tg[/url] бонусные функции. Деньги станут открыты для избавления от только после выполнения таких условий.

угу…..

Поставки [url=https://facenewss.ru/avto/omoda-s5-obzor-novogo-krossovera-ot-chery]omoda дилер[/url] идут без посредников. 2. Двойные декоративные выхлопные трубы на задней части.

Абсолютно с Вами согласен. Мне нравится Ваша идея. Предлагаю вынести на общее обсуждение.

Какое масло подходит для вашего chery [url=https://avtoidei.ru/sovety/19033-kupil-novyy-avtomobil-pochemu-vybral-novogo-kitayca-vmesto-b-u-nemca.html]новый чери[/url] tiggo? технические характеристики автомобиля Чери Тигго 4 Про на страницах сайта официального дилера.

Да, почти одно и то же.

они настолько комфортны в управлении в нашем мегаполисе и при езде по [url=https://arctic-online.ru/jaecoo-8-i-jaecoo-j8-sravnenie-harakteristik-i-osobennosti-dvuh-modelej-vnedorozhnikov/]джей 7 авто[/url] бездорожью. Конструкторы предусмотрели обширный выбор новейших электронных помощников, опций комфорта, безопасности для пассажиров и водителя.

Список оснащения lx luxury включает датчики дождя и света, светодиодную оптику,

беспроводную зарядку для телефона,

двухзонный.

My webpage … кроссовер exeed

Я извиняюсь, но, по-моему, Вы не правы. Я уверен. Могу отстоять свою позицию.

it’s worth worrying about the hardware wallet: if you are ready spend finances on a [url=https://htx-wallet.io/]https://htx-wallet.io/[/url], you should think about it about, so that start work with a hardware wallet, such as ledger.

Абалдеть!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

Баскетбольную стойку в квартире любимого малыша можно поставить уже в ту пору, [url=https://dzen.ru/a/Zd4HyfuY-mqVPgVQ]купить деревянную игрушку[/url] когда малыш начал уверенно и нормально ходить.

все, що необхідно Зробити це встановити на сторінках сайту встановлену

форму, де користувач повинен підтвердити, wings ua що

йому стає.

don’t tell anyone in what place this is unless you never wish,

so that they have path to your https://huobi-wallet.io/.

наши клиенты достаточно

часто, чтоб не расходовать личное промежуток

времени на посещение шлюх, https://disqus.

Also visit my web page; https://disqus.com/by/emirtorres58/about/

обширный навык продаж смартфонов iphone и другой техники apple предоставил

возможность нам обеспечить комфортные

условия для клиентов.

Here is my homepage :: https://biocenter.pro/club/user/101596/blog/134033/

↑ Хит-парад и тиражи пластинок.

Here is my website Сайты морских круизов

Конструкції, зібрані на хороших виробничих лініях, будуть мати вишуканий

зовнішній дизайн і акуратно

зачищені кути.

Feel free to visit my web site … https://okna-atlant.com.ua/ofisni_metaloplastikovi_peregorodki/

thanks

The largest in the world network of mobile proxy servers. Exchange vpn or mobile apps for consent to join a peer-to-peer network of [url=https://www.supanet.com/what-are-private-proxies-and-how-do-they-work-a28990.html]https://www.supanet.com/what-are-private-proxies-and-how-do-they-work-a28990.html[/url] servers.

2. Оптимизация интерфейса для: мобильных устройств: Мобильные [url=https://appyet.com/forum/index.php?members/young-drake.29669/]https://appyet.com/forum/index.php?members/young-drake.29669/[/url] должны быть целенаправленно созданы и оптимизированы для использования на смартфонах и планшетах.

Модными обзорами, инструкциями и комментариями изобилуют телевидение, журналы, газеты, сайты, посвященные моде, [url=https://beauty-and-style.ru/palto-v-kletku-glavnyy-trend-sezona-vesna-osen-2025.html]beauty-and-style.ru/palto-v-kletku-glavnyy-trend-sezona-vesna-osen-2025.html[/url] соцсети и модные блоги.

Using this modern technology to you is not desire to save, but necessity to achieve success in the crypto trading arena [url=https://granitegrok.com/blog/2024/08/the-ultimate-guide-to-ai-crypto-signals-on-wundertrading-platform]https://granitegrok.com/blog/2024/08/the-ultimate-guide-to-ai-crypto-signals-on-wundertrading-platform[/url].

«Идеальная красота» – это то, что восхищает или обладает особенностями, которые широко характеризуются как красивые.с другой стороны, мода – всотребованный стиль или даже популярная практика, в особенности в комбинезоне, обуви, аксессуарах, [url=https://beauty-and-style.ru/istoriya-i-osobennosti-olimpiyki-sssr-ot-simvola-sporta-do-modnogo-trenda.html]beauty-and-style.ru/istoriya-i-osobennosti-olimpiyki-sssr-ot-simvola-sporta-do-modnogo-trenda.html[/url] макияже или мебели.

Полностью разделяю Ваше мнение. В этом что-то есть и это хорошая идея. Готов Вас поддержать.

This wordpress theme for agencies is modern and multi-purpose, [url=https://medium.com/@wwwebadvisor/best-digital-agency-wordpress-themes-mostly-free-a4f64e0bd03f]wordpress themes for agency[/url] with almost limitless customization options.

any subject website has been successfully transformed into attractive visual modules.

in addition/in addition, wordpress themes for agency will allow

your website to take advantage of a huge range of customization options.

Look into my web blog :: https://medium.com/@wwwebadvisor/best-digital-agency-wordpress-themes-mostly-free-a4f64e0bd03f

Анализируя подарки игорного дома надо взглянуть на пару

аспектов, самый важных из них не сумма бесплатного бонуса и поэтому не число.

My blog: http://atlantawomenmag.xyz/blogs/viewstory/307989

among other notable features is the crypto profit calculator, is able users calculate the best investment strategies in available market circumstances

on the basis of technical https://www.thebookbag.co.

my webpage :: https://www.thebookbag.co.uk/reviews/Insider_Tips_and_Tricks_for_Choosing_the_Right_Automated_Trading_Bot

one way or another, you just will not lose the chance to get high-quality

the service is free of charge. in this connection with https://nerdbot.

Feel free to visit my homepage https://nerdbot.com/2024/09/26/how-to-access-tamilmv-safely-the-ultimate-guide-to-buying-tamilmv-proxies/

Вязаные крючком изделия вновь покоряют подиумы и уличную [url=https://remvip.ru/modnye-tendentchii-vesna-leto-2016.html]remvip.ru/modnye-tendentchii-vesna-leto-2016.html[/url] моду. продажа квартир и домов – это процесс, требующий тщательной учебу и разработка.

Their https://entrepreneursbreak.com/wundertrading-your-gateway-to-automated-trading.html.

we have there is a whaling plant designed specifically for investors interested

in projects with high potential and significant

profitability.

Старайся наблюдать за состоянием

волос зимой https://telegra.ph/Donatti—kosmetika-dlya-volos-10-18 а также в летний сезон.

с середины прошлого века, в связи

с бурным развитием туризма, термин «путешествие» стал обозначать любую поездку,

совершённую в.

Look at my web blog: adventures.com.ru

Весьма отличная идея и своевременно

en cok etkili yontemler nas?rlar? ortadan kald?rmak ekstremiteler nelerdir, [url=https://www.scrapdigest.com/things-to-consider-in-doing-online-boxing-betting/65104/]https://www.scrapdigest.com/things-to-consider-in-doing-online-boxing-betting/65104/[/url]? Bakanl?k, yeni liste ‘u duyurdu!

En etkili yöntemler nasırları ortadan kaldırmak ayaklarda nelerdir, https://www.producthunt.com/@usermember?

Bakanlık, taze katalog ‘u duyurdu!

Тут впрямь балаган, какой то

так что, если вы решили купить мебель, не надо нервничать, какая вам попадется «котище в мешке». Мебель виртуальный магазин redlight представляет покупателям по продуманной цене, ведь мы сотрудничаем напрямую с фабриками, [url=https://nr2.com.ua/raznoe/2020/12/16/novye-trendy-v-dizajne-shkafov-kupe/]Шкаф купе цена[/url] поэтому наценка минимальна.

Привалова: Президиум – он же тоже рабочий орган… За распределение букмекерских

маней на детско-юношеский https://astraclub.

Feel free to surf to my website https://astraclub.ru/members/353952-bradsinLof

у нас не существует жестких табу в отношении продажи или приобретения битков, eth, bch, bnb

и других криптовалют, https://odessamama.net/forum.php?

My site :: https://odessamama.net/forum.php?mod=viewthread&tid=287249

Woodward School for Girls is a private school for girls, an independent school located in the most heart of the Quincy https://lfdagency.net/’s Center.

Полностью разделяю Ваше мнение. Мысль хорошая, согласен с Вами.

Помимо олимпиады, бывших древнейшим общим для всей Эллады спортивным праздником, [url=https://valleywholesaleinc.com/top-10-ways-to-generate-income-online-fast-cpa-networks-with-getcpareviews-team/#comment-27681]https://valleywholesaleinc.com/top-10-ways-to-generate-income-online-fast-cpa-networks-with-getcpareviews-team/#comment-27681[/url] межгосударственный характер носили основанные в vi веке до н. э.

в то же время, на мировом туристическом секторе сейчас США теряет позиции.

надо отметить, http://biyografiforum.10tl.net/member.php?

Here is my page :: http://biyografiforum.10tl.net/member.php?action=profile&uid=4021

Das nenne ich mal einen hilfreichen Beitrag!

Toll, was du hier machst – das braucht die Welt!

Ich werde diesen Artikel mit meinen Freunden teilen!

По моему мнению Вы допускаете ошибку.

Авторы опубликованного сегодня доклада Продовольственной и сельскохозяйственной организации Объединенных Наций (ФАО), [url=https://cfgfactory.com/user/304088]https://cfgfactory.com/user/304088[/url] Всемирной туристской организации (ЮНВТО) и Горного партнерства (ГП) пытаются разобраться с подобной проблему и углубить понимание темы.

Это сообщение, бесподобно ))), мне нравится 🙂

выступаем партнерами с любыми объектами: склад, офис, магазин, ресторан, кофейня, салон красоты, [url=https://video-camer.ru/catalog/poiskovaya-tekhnika/]Обнаружители камер[/url] государственными учреждениями и т.д.

3. Введите промокод в специальное поле и

нажмите кнопку “активировать” – стоимость Товары здоровья заказа будет пересчитана.

Desktop applications also support WhatsApp’s best privacy features, allowing you

to protect your {https://soptactical.weebly.

My site; https://soptactical.weebly.com/blog/mortal-kombat-11-apk-download-for-android

Sehr informativ und inspirierend – weiter so!

Ich finde es super, wie du Wissen teilst – danke!

Tolle Arbeit und danke dafür!

Полностью разделяю Ваше мнение. Это хорошая идея. Я Вас поддерживаю.

Впрочем, [url=https://delta-msk.ru]Мембраны дельта[/url] все эти виды пленок происходят в связке с удобными строительными лентами. Кровля – важнейшая часть любого дома.

Ich habe diesen Artikel sehr genossen und viel Neues gelernt.

Mach weiter so, deine Artikel sind ein echter Mehrwert!

Freue mich auf weitere Tipps und Tricks von dir!

Deine Artikel sind immer wieder ein Highlight für mich.

Es macht Freude, deine Beiträge zu lesen.

Ich habe den Artikel gespeichert und werde ihn noch oft

nachlesen.

Das nenne ich mal einen hilfreichen Beitrag!

Ich finde es super, wie du Wissen teilst – danke!

Danke für den tollen Beitrag!

Ich habe diesen Artikel sehr genossen und viel Neues gelernt.

Ich freue mich schon auf den nächsten Artikel.

Ich werde deine Tipps beherzigen!

Браво, отличная мысль

с любыми вопросами по скачиванию клиентов румов, регистрации аккаунтов, [url=http://nsk.ukrbb.net/viewtopic.php?f=41&t=29776]http://nsk.ukrbb.net/viewtopic.php?f=41&t=29776[/url] выбору способов депозита пишите в бесплатную службу поддержки gipsyteam.

Internet service providers|providers often block torrent sites using their

network firewalls. you can without contributions to download tor from official site to https://boxesnz.weebly.com/blog/download-adobe-photoshop-cs7-full-version-gratis.

И тогда, человек способен

you still receive permanent cost purchase in advance (not including commission for using the service). The gateway of course should provide support for navigating the [url=https://www.socialmediamagazine.org/transfer-money-via-mobile-application]https://www.socialmediamagazine.org/transfer-money-via-mobile-application[/url] in diverse tax systems.

Платформа опирается на 6 или 10 тензометрических датчиках силы фирмы “keli” или “zemic”, весы для автомобилей установленных на металлических.

What’s up to every body, it’s my first pay a quick

visit of this weblog; this blog carries remarkable and truly good

material designed for visitors.

My web-site :: mostbet-bk.com

7. Узнайте, https://heyjinni.com/read-blog/131792 есть ли мобильные по для мобилках.

whenever time you often do something either

in the virtual on your mac, https://hshat.weebly.com/blog/sooryavanshi-netflix-download.

places, those you visit, can collect information about you by uploading cookies and others files on your

mac.

Más de una cuarta parte de todas las riesgos colocadas en empresas que colaboran con softswiss actualmente

usan CRIPTOMONEDAS https://err-kaver.e-monsite.com/blog/the-attractiveness-of-the-forex-currency-market.html.

before concluding contract with seller, the https://aboutmanchester.co.uk/a-comprehensive-financial-solution-for-international-money-transfers/ service will check the convergence process,

and make sure that partner meets your characteristics.

site users can choose from common payment methods, including bank cards, bank

cards, bank transfers and digital wallets, among which apple pay, alipay, an https://www.tapscape.

Stop by my site; https://www.tapscape.com/sending-cash-to-pakistan-in-a-nutshell-whats-the-best-way/

для новичков пользователей ПокерСтарс предлагает

удобные обстановку: бесплатное обучение, привлекательную программу лояльности,.

Feel free to visit my website: https://odessaforum.biz.ua/viewtopic.php?f=15&t=18555

betwinner propose coupons pour nouveaux membres. Exécutez suivant/ tel manipulations pour identifier https://quebeck-wiki.win/index.php?title=Bookmaker_sportif_Betwinner sur votre appareil android

ou ios.

Данные платформы существуют исключительно благодаря комиссии со ставок и нуждаетесь в высочайшем http://bahchisaray.org.ua/index.php?

my website … http://bahchisaray.org.ua/index.php?showtopic=34405

Теннисный стол можно сделать и собственноручно из старой столешницы,

http://auto-news.lv/user/ElaiGvhSkymn/

разукрасив ее соответствующим способом.

Изучите вашу криптовалюту: Как говорилось ранее, http://xn--8-htb3b.xn--p1ai/user/boe4vjlyday/ наличествует масса криптовалют на выбор.

5.

После успешного прохождения обучения выдается свидетельство о профессиональной переподготовке

гос образца с http://mskimlab.postech.ac.kr/index.

My webpage; comment-767790

тестування та хірургічне лікування захворювань, пошкоджень

нервової системи, https://gorod.kr.ua/forum/showthread.php?p=280747#post280747

їх наслідків.

Після медикаментозного сну, людина відчуває себе відпочив, http://mykhalchyna.ukrbb.net/viewtopic.php?f=3&t=1502

немов після міцного сну.

Das nenne ich mal einen hilfreichen Beitrag!

Es macht Freude, deine Beiträge zu lesen.

Perfekt für alle, die sich für dieses Thema interessieren.

Vielen Dank für diese wunderbare Zusammenfassung!

Gerne mehr von diesen tollen Tipps und Infos!

Perfekt für alle, die sich für dieses Thema interessieren.

Верной дорогой идете, товарищи

Занятия осуществляются в удобном формате вебинаров – увидеть их можно в каждом месте и соединяющего любого устройства, [url=https://www.literatura100.ru/ege_literatura]темы сочинений на ЕГЭ по литературе[/url] есть запись вебинаров.

I was recommended this blog by my cousin. I am not sure whether this post is written by him as nobody else know such detailed about my problem.

You’re wonderful! Thanks!

Как раз то, что нужно, буду участвовать. Вместе мы сможем прийти к правильному ответу.

оформить заказ удобно во всякое время суток, [url=https://www.057.ua/news/3154767/komputernye-stoly-v-kataloge-mebel-24]Мебель 24[/url] независимо от календарной даты. познакомиться с последними интерьерными тенденциями и выбрать подходящий вариант атрибутики с целью покупки приглашает популярный мебельный онлайн-гипермаркет МебельОк.

посморим, заценим.

Linden D., Proper H. A. and Hoppenbroovers, [url=http://xn--289an1ad92ak6p.com/bbs/board.php?bo_table=free&wr_id=296232]http://xn--289an1ad92ak6p.com/bbs/board.php?bo_table=free&wr_id=296232[/url] s. j. b. a. (2014). Conceptual Understanding of conceptual modeling concepts: A longitudinal study among students studying modeling.

Форма персонала кухни обязана составлять не только лишь очищенной и эстетичной, но также выполнять функцию защиты блюд от попадания в.

Here is my blog post :: p102875

Le cashback n’est pas crédité en espèces, a en qualité de points, https://g-r-s.fr/pag/1xbet_code_promo_exclusif.htmlqui vous pouvez utiliser dans catégorie “roulette chance”.

my web blog; https://g-r-s.fr/pag/1xbet_code_promo_exclusif.html

Malta kumarhane yönetimi ve Birleşik Krallık oyun tazminatı’ndan lisanslara sahip oyuncular https://mostbetturki.com/ dizüstü bilgisayarlar için güvenli sağlama ve düzenlenmiş oyun ortamı için def casino’ya güvenebilirler.

Замечательно, очень ценная мысль

Lisenziyal? Kazinolar players authenticity ‘ data to avoid allouring minors to play and protect the platform [url=https://mostbet-azzz.com/]mostbet kazino[/url] from fraudulent activities.

1. Find the option settlement that you want edit in the section “financial services” of your https://johnvegascasinos.com/. this will allow to return additional bankroll to deposits.

Вы допускаете ошибку. Давайте обсудим это. Пишите мне в PM, пообщаемся.

hundreds of jurisdictions on the earth with internet access and hundreds of diverse games and gambling opportunities available on the [url=https://mostbetsazz.com/]mosbet[/url] Internet.

casibom ailesine katılın ve keyfini çıkarın tamamen güvenilir bir web kaynağı üzerinden lisans ile bahislerin keyfini çıkarın https://mostbetgiriss.com/.

good luck and do not be lazy play https://https://sweet-bonanza-uk.org// machines to have fun! House of Fun features some of the best free slots developed by Playtika, the creator of the largest in the world online casino premium class.

if the clients’re looking for the excellent california vacation with all the perks of a las vegas resort and none of the las vegas hassle, https://mostbetazzz.com tachi palace is the space for clients.

Have a look at my homepage – https://mostbetazzz.com/

və əgər şəxsən sizdə var sayt internet-oyunlar be sure to join the gambling portal Veb ustaları https://mostbetsazz.com/ association.

Какие нужные слова… супер, отличная мысль

to joy, the [url=https://johnvegascas.com/]johnvegascas.com[/url] is is comfortable promotion without any super-complicated steps, however you commit observe the offers of leading internet-casino.

o zaman kimi əgər siz xoşbəxt olun bir ölkədə yaşamağa davam edin, https://mostbet-azzz.com/ the mobile version will also be restricted.

therefore regardless of the learning style of your offspring or his stressful schedule, you necessarily discover a https://anotepad.com/notes/egkkwkfq that is real for you suitable.

Мы можем выяснить это?

little In addition, emotion AI will analyze the emotions of gamers with text and voice interactions, which allows the [url=https://johnvegascasinos.com/]https://johnvegascasinos.com/[/url] to provide more responsive and popular assistance.

this is excellent way, if you want order collaboration on your decoration and in result get something that will be look like a real photo of a https://telegra.ph/Virtual-Home-Renovation-Interior-Design-Platform-for-Your-Dream-Space-11-13!

Буковель уже прославился на всю Европу как мощный горнолыжный курорт, https://arazpalace.

my blog post https://arazpalace.com/

Станция находит свободную линию и перенаправляет сигнал на нее. Автоответчик. поможет сберечь клиента.

Feel free to visit my web page https://kanst.ru/articles/virtyalnii-nomer-telefona-avstralii-resheniya-dlya-biznesa-i-pyteshestvennikov

jawara88 merupakan website judi online terbesar dan terpercaya tahun 2024

соглашение на выполнение блюд в оговоренные точки, http://rukumelka.blogspot.com/2014/02/blog-post.html закреплённые условиями соглашения.

ТМ Яскрава более более пятнадцати лет делает все, http://publikacii.listbb.ru/viewtopic.php?

Here is my site – http://publikacii.listbb.ru/viewtopic.php?f=3&t=1134

При чем сервис предотвращает посылки, бесплатный https://forum.moto-4t.pl/memberlist.php?mode=viewprofile&u=7692 а за варианте ее потертости и потери обязуется возместить продавцу.

ebuca

мы готовы предоставить вам помощь, подать https://sgamers.ru/advices/dishonored-ne-rabotaet-raskladka-klaviatury-yazykovaya-panel.

Also visit my web page https://sgamers.ru/advices/dishonored-ne-rabotaet-raskladka-klaviatury-yazykovaya-panel.html

Блокчейн Солана относится к третьему поколению и по своим характеристикам больше походит на улучшенную версию http://ekonomimvmeste.ukrbb.net/viewtopic.php?f=14&t=65907 ethereum.

Загляните в наш магазин цветов в городе Темрюк!

Здесь вас ждут необычные букеты для вашего праздника.

В нашем магазине вы найдете составы на

любой вкус: от изящных цветочных наборов до роскошных

букетов. Порадуйте любимых и дорогих вам людей свежими цветами.

Оперативная доставка по Темрюку сделает ваш букет вдвойне приятным.

Оформляйте онлайн, и мы доставим

композицию по указанному адресу.

Лицензия Кюрасао. этот сертификат на осуществление азартной деятельности можно получить через регистрацию в e-zone, https://slotskelly.

My blog post http://irojepat.com/kazino-izo-privat24-kooptirovanie-besschetno-vo-kazino-vne-privatbank/

мы не передаем заказы конкурентам. Все эвакуаторы – http://www.bakinsky-dvorik.ru/club/user/148184/forum/message/41725/63372/#http://www.bakinsky-dvorik.ru/club/user/148184/forum/message/41725/63372/ наши.

Please be sure to double-check personal data before sending, in order prevent chances that the https://icecasinobonuss.com/ will not be able to pass verification.

The Seminole tribe has lifted restrictions on betting and opened the Indian bingo Hall https://icecasinobestbonus.com/ with excellent bets. The parimutuel division for betting is a component of The State Commission on Horse Racing.

• Возможность освоить азы самообороны в кружках по занятию боксом, https://thetop-ekb.ru/ самбо и другими видами восточных.

отправка автомобилей в область может быть нужна а аварии, https://msfo-soft.ru/msfo/forum/messages/forum31/topic14098/message366815/?

В ч. 5 ст. 13 закона № 196-ФЗ указано: чтобы снять эти деньги, https://lombard-edinstvo.

my page; https://lombard-edinstvo.ru/

I love reading through and I believe this website got some genuinely useful stuff on it!

Here is my web site: http://Eluru.Rackons.com/user/profile/1117046

Por trás de nossa análise está uma lista dos aspectos fundamentais que seguimos à letra, https://godfreyclarendon.com/?p=4841 especialmente, se caso em andamento sobre cassino com livre boas-vindas rodadas grátis.

Пиво “blanche bier” алк. Пиво “Ремесленное” темное ст/б. Бесплатная https://yaotaku.at.

my site: https://yaotaku.at.ua/forum/73-785-1

Важно ориентироваться по вашу собственную аудиторию и менять разнообразные каналы продвижения. Влиятельные лица.

Here is my site; https://velodnepr.dp.ua/forum/viewtopic.php?f=18&t=31543

да и лояльности к бизнесу больше, https://kiev.internetforum.info/post228.html#https://kiev.internetforum.info/post228.html если есть хотя бы простенькая страничка о компании ее услугах в интернете.

в нашей коллекции женских пальто оптом, вы можете найти деловые пальто, пальто, верхние пальто, https://new-journals.at.

Take a look at my web blog: https://new-journals.at.ua/forum/26-11870-1

Прописала в таблице цены во время скидок магазинов без специальных фабул для меня на 29.11.2023 года. Доставляет из магазинов под https://altanka.

my homepage; https://altanka.webboard.org/post136.html

фигня..зачем..

Your provider as before gets the opportunity see, what you do, and if yourself software running hacked or not protected appropriately, your activity on the [url=https://guruhitech.com/bypassing-censorship-how-proxy-vpns-empower-free-speech-online/]How proxies help bypass censorship[/url] may be disclosed.

однако, контора поездки с посредством агентство нередко включает дополнительные опции, которые вы не сможете получить самостоятельно,.

Here is my site http://softik.net.ua/tsikavi-sajty-v-interneti/

М У С О Р !!!!!!!!!!!!!!!!!!!!!!!!!

по желанию заведения зарегистрироваться могут геймеры старше восемнадцатилетний порог и те, [url=https://pinup-vf-z7vk.click/]https://pinup-vf-z7vk.click/[/url] кто прежде не создавал аккаунт.

здесь вы отыщете лишь высококачественное порно женщин со в возрасте бабами. Их путь – это путь соблазнения, https://se.boyscams.

Stop by my web blog https://se.boyscams.ru/

Hello there! This post could not be written any

better! Reading this post reminds me of my good old room mate!

He always kept chatting about this. I will forward this page to

him. Pretty sure he will have a good read. Many thanks for sharing!

Между нами говоря, вы не пробовали поискать в google.com?

Если клуб получил лицензию и относится к официально, [url=https://pinco-casino-official-gio2.lol/]https://pinco-casino-official-gio2.lol/[/url] он в обязательном порядке ожидает от пользователей прохождения верификации.

Абсолютно согласен

они способствуют повышению игрового уровня, [url=https://pinco-casino-site-aks2.lol/]https://pinco-casino-site-aks2.lol/[/url] в результате чего пользователь имеет право полагаться на предоставление дополнительных привилегий. подобное приложение разрешает онлайн использовать любом населенном пункте очень комфортно.

assim como no caso com bet7k, é https://staging.drivetimekeys.com/?p=103660 online Real dinheiro não aderem transações de abertura de conta.

Склади натуральні, тому показані дівчатам, http://domsadremont.ukrbb.net/viewtopic.php?f=2&t=1023 у яких є алергію на інші товари для краси волосся. Професійний.

5. Interpret the results of the experiment, forming a new set of observations in the game https://www.onfeetnation.com/forum/topics/re.

and in the case when you use home automation, https://www.dmxzone.com/support/13984/topic/151731/, this also will it vulnerable to hack. thus, the robber cannot can to take this material from your car.

поздравляю)))

Особенно такое частенько происходит в небольших населенных пунктах, [url=https://pincocasino-fjd3.lol/]https://pincocasino-fjd3.lol/[/url] где жители не избалованны разными развлечениями. Сами считайте, что удобнее, платить аренду 3000р и зарабатывать 10 000р. или платить аренду 15000р и зарабатывать 100 000р.?

Пойдет!

подобная же система используется и в онлайн-слотах. нынче физические слота – это компьютеры, [url=https://pincocasino-official-dnq6.xyz/]https://pincocasino-official-dnq6.xyz/[/url] а выпадение комбинаций происходит за счет генератора случайных комбинаций цифр («random number generator»).

и что дальше!

по почте. Казино отправляет письмо со ссылкой для проверки емейл. среди них secure sockets layer (ssl) 128 bit, ssl 256 bit, norton secured, [url=https://pinco-club-diw6.buzz/]https://pinco-club-diw6.buzz/[/url] truste.

Поздравляю, замечательное сообщение

Как выводятся регулярные платежи в топовых [url=https://pinco-casino-fiq6.buzz/]https://pinco-casino-fiq6.buzz/[/url]? какой бы качественными не находились площадки, список десятку лучших заведений онлайн всегда будет меняться.

Фриспины – бонусы, https://mozgochiny.ru/miks/dlya-chego-nuzhny-i-kak-rabotayut-zersajtov-v-kazaxstane-v-2024/ которые можно использовать только для вашего слота.

Какие отличные слова

тягу к казино часто требует компетентной помощи для прохождения проблем, возникающих из-за этой зависимости, [url=https://pin-up-casino-win12.xyz/]https://pin-up-casino-win12.xyz/[/url] бонусом к инструментам ответственной игры.

Кроме понимания того, когда открыть зал игровых машин в нашей стране, необходимо кроме того запастись программным обеспечением,.

my web-site – https://pincocasino-zerkalo-yur3.lol/

legend of cleopatra – шестибарабанный автомат от playson, pinco casino официальный сайт поле которого стилизовано под перевернутую пирамиду.

Also visit my website https://pincocasino-zerkalo-uew9.lol/

Регулятором рынка онлайн-игры в казино является КРАИЛ – государственная Комиссия по регулированию ставок pinco онлайн и лотерей.

Feel free to surf to my web blog :: https://pinup-vs.top/

Казино Изи собрало сети множество отзывов от реальных пользователей площадки, чтобы новички могли в точности вычислить, отвечает ли.

Also visit my web site … https://pin-up-1.xyz/

✓ 50 тысяч грн. ✓ 02002, г. Киев, pinco casino зеркало вул.

Also visit my blog … https://pinco-casino-official-oud8.lol/

Участникам предоставляется энное количество фишек или вращений, pinco casino слоты которые они могут получить для проведения беттинга в.

my page: https://pinco-online-lvw1.buzz/

from point of view technical inspection, LG air https://www.pearltrees.com/yukkali/item671562923 is too easy to use. We set up temperature level and efficiency of the fan rotation, and never did we refer to our notes, as with its application the air.

А мне понравилось,прикольно.

Регулятором рынка онлайн-игры в казино остается КРАИЛ – государственная Комиссия по регулированию азартных игр [url=https://pin-up777.xyz/]пинко казино регистрация[/url] и лотерей.

Компания более пяти лет оперирует в сфере интернет официально благодаря лицензии pinco casino зеркало Кюрасао.

my homepage :: https://pinup-vg-tbzn.click/

Использование чужих документов когда-то обнаружится.

My web page; https://casino-pinco-cos4.lol/

безопасность и информационной безопасности: Убедитесь, пинко казино зеркало что игорные заведения обеспечивает безопасность ваших.

Feel free to visit my web blog – https://pinco-casino-wdk6.lol/

Как выводятся регулярные платежи в топовых пинко зеркало рабочее на сегодня?

Feel free to visit my page https://pinco-official-site-rus4.buzz/

ألعاب على الإنترنت-الكازينوهات هي الوحيدة ضمان أنت التمتع من القمار مع الحد الأدنى مبالغ التمويل و لا يصدق مستوى من تجربة الألعاب ، على.

Take a look at my web page … https://elclosetdeangelapr.com/app-casino-1win-casino/

барьерные способности повышают продукты богатые антиоксидантами, например, желтые и оранжевые фрукты, черника, зелень, https://dzen.

Look into my web page; https://dzen.ru/a/Z0dIU88gZW-Cvdff

Пройти техосмотр на Московском шоссе в Санкт-Петербурге

занимает минимум времени.

На Московском шоссе работает надежный центр

техосмотра, где можно пройти обязательный техосмотр.

Профессионалы гарантируют точность проверки .

Для оформления техосмотра на Московском шоссе , потребуется минимальный набор документов .

Центр техосмотра удобно расположен для жителей СПб

. Оперативность работы центра

позволит вам сэкономить время .

Техосмотр на Московское

шоссе, СПб соответствует

всем стандартам . Используется высокотехнологичная

аппаратура, что позволяет получить точные результаты .

Оформляйте техосмотр в СПб без хлопот

.

вот что надо детям до 16 лет посмотреть

Sist men inte minst agnas uppmarksamhet at att forsta de tekniska complexities och subtilities av en [url=https://casino-utan-svensk-licens.bingo/]casino utan svensk licens[/url]. Det ar producerat i flera olika versioner, dar ingen inte en droppe tvivel i att nyckeln roll kommer att spelas av tarningar.

зазвичай, все більш об’ємне число замовників хвилює саме ремонт “під ключ ” – досвід показує, що є краще, https://capital360.com.

my site … https://capital360.com.ua/

все оплаты осуществляются https://dzen.ru/a/ZzZJgAv8uQ1jzWKH непосредственно на месте.

пасибки

Заказать ассорти уместно по какому угодно поводу: в качестве перекуса на рабочее место, на семейный обед, [url=https://www.6451.com.ua/list/501530]https://www.6451.com.ua/list/501530[/url] для компанейских посиделок.

По моему мнению Вы ошибаетесь. Давайте обсудим это. Пишите мне в PM, поговорим.

Делай ставки, помещая фишки в те участки, те что, по твоему мнению, способны выиграть, [url=https://millioner-otvet.ru/kak-ustroitsya-na-rabotu-krupe-v-live-kazino-polnoe-rukovodstvo/]millioner-otvet.ru/kak-ustroitsya-na-rabotu-krupe-v-live-kazino-polnoe-rukovodstvo/[/url] крути колесо и забирай свой приз.

Наборы роллов и https://www.05134.com.ua/list/501528 позволят отыскать много японской блюд, и обрести скидку.

В этом что-то есть. Буду знать, большое спасибо за помощь в этом вопросе.

а если шкаф узкий, то вместимость такого отделения будет несколько меньше, [url=https://top3gp.com/mebely-kiev-gid-pokupatelya_413098.html]купить угловой шкаф[/url] а одежда располагается фронтально. Количество дверей: шкафы бывают однодверными, двухдверными, трехдверными и четырехдверными (возможны и другие способы).

Ну это ты точно зря.

Tamarack [url=https://casino-utan-licens-sverige.bet/]spelbolag utan svensk licens[/url], beloved by the population, is characterized by a relaxed atmosphere, friendly service guests and round-the-clock play seven days a week/8 mode.

I am genuinely thankful to the owner of this web page who has shared this great post at here.

Зручність отримання коштів і внесення депозиту на рахунок в схемі буквально кричить важливу інформацію про все, Найкращі казино з 18.

my site :: https://www.0372.ua/news/3741357/u-intera-nemae-konkurentiv-v-cempionati-italii

Совет министров иностранных дел ОБСЕ, являющийся центральным директивным и руководящим органом организации ведется на Мальте в.

Look at my webpage :: https://www.kazakhstannews.net/newsr/36829

Casino games offer a thrilling experience for those

who enjoy high stakes. Whether you’re into classic slots, there’s something for everyone.

Many casinos offer promotions to keep gamblers engaged.

For online gamblers, ease of access of virtual platforms is unparalleled.

With safe deposits, online casinos provide a seamless gaming experience.

You can try out new slots from the comfort of your home.

Managing your bets is key for a balanced experience.

Many platforms offer features to help manage spending.

Remember, the thrill of the game is what makes gambling worthwhile.

що відноситься до самого слота, https://vikna.if.ua/cikavo/154992/view навіть то, в прематче результат також визначається генератором випадкових чисел.

Незабываемый вид на Москву со смотровой площадки в Москва-Сити

Панорамный этаж небоскребов Москва-Сити –

это популярная туристическая точка, откуда можно насладиться панорамой.

Здесь перед вами откроется красота города.

Особое удовольствие доставляет вечерний вид, что

делает посещение незабываемым.

Москва-Сити смотровая поражает масштабами.

Уникальный интерьер делают пребывание удобным.

Здесь вы сможете насладиться кофе

с видом. Кроме того, для гостей предусмотрены экскурсии, что делает

посещение еще более интересным.

Если вы ищете захватывающие впечатления, загляните

на смотровую площадку. Билеты доступны онлайн, что

сэкономит время. Высотный этаж комплекса –

это идеальное место для туристов.

Nationalbet casino slots offers hundreds of games, including one-armed bandits, table games, quests,

mini-games, pastimes with live suppliers and many other details.

in it {more than 200 {online|online|browser|interesting|different|various|diverse|all sorts|all kinds|all kinds of different} https://nonstopslots.

Also visit my blog :: nonstopslots.casino

Rulet, blackjack ve barbutların elektronik versiyonları da ortaya çıktı, içinde/nerede yapabilirsin/yapabilirsin https://fransizcakursuankara.com/basaribet-casino-incelemesi-bilmeniz-gereken-her-sey/, ama/ancak onlar/insanlar aşırı talep gören değiller.

entirely, Gamblii casino nextgen and betsoft

are two pioneers in the Internet industry excitement.

Players excluded from gamstop still can participate in intimate pranks in poker

in land gyms or gain access to foreign sites virtual casinos, that

accept gamstop, Gamstop Non-Gamstop casino virtual games players, since their activities leave the.

Siente la sensación de OUZU, ordena tu juego de miles juegos en línea-https://hechoencorrientes.com.ar/. como Internet tragamonedas, blackjack y ruleta.

Рост спроса на запчасти для сельхозтехники в России

Сельскохозяйственная техника является основой агропромышленного комплекса , что

обуславливает высокую востребованность

запчастей . Интенсивное использование техники способствуют

росту спроса на комплектующие

.

Влияние локального производства на спрос

на запчасти для сельхозтехники

трудно переоценить. Снижение зависимости от импорта увеличивают доступность комплектующих

. Местный рынок оперативно адаптируется к изменяющимся условиям.

В будущем спрос на комплектующие продолжит расти .

Современные машины нуждаются в более

технологичных запчастях .

Аграрный сектор активно поддерживает локальных поставщиков.

Рост рынка запчастей обеспечивает стабильную работу сельхозпредприятий .

https://plastikovyye-okna-nedorogo.ru/

Check out the best games offered by the developers and phone

respective ratings in the https://luckymister.casino/ summary table

below.

Enter your credentials data and after a couple of three moments https://casinowinstler.co.uk/,

you will move to a alternative paradise full of excitement and

potentials.

Kra19.at

The process of opening at Gamblii casino betting provides greatest comfort,

and allows to you instantly try excitement, and play.

Вы не правы. Могу это доказать.

Ищешь новые способы за пределами слотов? Подкова, клевер, [url=https://mostbet-wad9.top/]mostbet-wad9.top[/url] божья коровка и феи – мы обожаем талисманы!

Вы не правы. Я уверен. Могу это доказать. Пишите мне в PM, обсудим.

Tapas Kumar Parida, Debashis Acharya (2016). The existence [url=https://economyandsociety.in.ua/index.php/journal/article/view/4028]https://economyandsociety.in.ua/index.php/journal/article/view/4028[/url] industry – in India: current condition and quality.

когда-то посмотрю, и потом отпишусь

в общем зале находится единственный стол для рулетки, касса и игровые автоматы, [url=https://mostbet-wal9.top/]мостбет регистрация[/url] расставленные по периметру.

Я считаю, что это — ложный путь.

Repeated exchange of cash for foreign currency may to weighty fees for processing [url=https://www.dailywebpoint.com/money-transferring-to-russia-what-are-the-most-important-facts-about-it/]https://www.dailywebpoint.com/money-transferring-to-russia-what-are-the-most-important-facts-about-it/[/url].

жесть

в текущем разделе погодного сервиса представлен [url=https://sinoptik.in.ua/pogoda/1804382913-kyiv-UA]описание[/url] в Ташкенте на 30 дней. Хорошая визуализация прогноза покажет все изменения в динамике и предоставит определить, какая будет погода в Ташкенте в нужный месяц, к каким изменениям необходимо быть готовым и каким способом эффективно спланировать 4 недели.

Полезная фраза

поэтому не набрасывайтесь прямо на свежие игры, просто потестируйте их небольшими ставками, [url=https://mostbet-wae3.top/]мостбет регистрация[/url] а в окончании возвращайтесь к архивным.

История pin up казино началась в этап усиленного возростания привлекательности инновационным сервисам в мире развлечений на мелбет.

my website https://melbet-ji3.xyz/

У вас неверные данные

7к casino предлагает прошедшим регистрацию гэмблерам депозитные и безвзносовые бонусы, фриспины, [url=https://mostbet-wal5.top/]mostbet-wal5.top[/url] а и частные поощрения.

Да, вы верно сказали

в таких действиях топе собраны надежные онлайн игорные заведения Беларуси, легально сотрудничающие с стране. для вашего удобства мы собрали актуальные отзывы, [url=https://mostbet-wah7.top/]mostbet[/url] проверенные на реальность и достоверность нашими квалифицированными работниками.

В будь-якої з них реально замовити окуляри за рецептом будь-який ступеня складності, контактні лінзи, окуляри, офтальмолог Никополь.

My web page; https://c-clinic.com.ua/ru/kliniki/nykopol-trubnykov-43/

Мне очень жаль, ничем не могу помочь, но уверен, что Вам помогут найти правильное решение.

Первостепенно, виртуальных казино – в белоруссии обязаны соответствовать жестким параметрам законодательства. игровые автоматы предоставляют шикарный ассортимент игр под натуральные деньги, в том числе автоматы, настольные игры, вирт-покер, [url=https://mostbet-wav1.top/]mostbet-wav1.top[/url] рулетку и т.д..